EMBARGOED UNTIL MONDAY 6:00 CEST, 20 SEPTEMBER 2021

Stepping On The Gas

Poland is planning the biggest fossil gas expansion in Europe, as revealed by Ember’s analysis of Poland’s energy strategy, Polish Energy Policy until 2040 (PEP2040).

- In this piece we consider how feasible it is that Poland’s gas plans will materialise, analysing planned new gas projects and coal-to-gas conversions. We also highlight threats associated with the coal-to-gas switch, underscoring regulatory risks that may lock Poland into gas dependency, leading to a failure to reach net-zero by 2050.

Key takeaways:

- Poland plans the largest expansion of gas in Europe this decade. These“aspirations” are aligned with planned capacity additions: if all proposed gas projects are delivered they would exceed the government’s 2030 target.

- 70% of planned fossil gas capacity additions are electricity-only, despite the availability of lower cost alternatives such as renewables

- Little consideration is given to how gas investments might lock Poland into gas dependency beyond 2050, resulting in Poland failing to achieve net zero.

- Forthcoming EU legislation might reduce financing sources for planned gas projects and increase operating costs, thereby decreasing the profitability of the planned investments.

ANALYSIS

- Poland is planning the biggest gas expansion in the EU

Ember analysis identified that Poland is planning the biggest gas expansion in the EU by 2030, in an unusual move for a country that lacks significant fossil gas resources. Poland’s energy strategy (PEP2040) revealed that it intends to almost quadruple fossil gas use in electricity generation from 14 TWh in 2019 to 54 TWh in 2030. This would make it the EU’s third largest gas-generating country by 2030.

The gas expansion plans in PEP2040 marked a significant shift in strategy. Previously, Poland planned to increase gas use by only 7 TWh between 2019 and 2030, compared to 41 TWh in the latest plan.

According to PEP2040, the 41 TWh increase will translate to 8.2 GW of net installed gas capacity by 2030. Notably, Poland plans further increases in gas capacity beyond 2030, reaching 15.7 GW in 2040, only 3.6 GW of which is expected to be peaking gas.

| 2019 | 2030 | 2040 | |

| Installed capacity (net) [GW] | 2.6 | 8.2 | 15.8 (including 3.6GW of gas peaking) |

| Electricity generation (gross) [TWh] | 14 | 54 | 69 |

Source: energy.instrat.pl, Ember’s calculations, PEP2040.

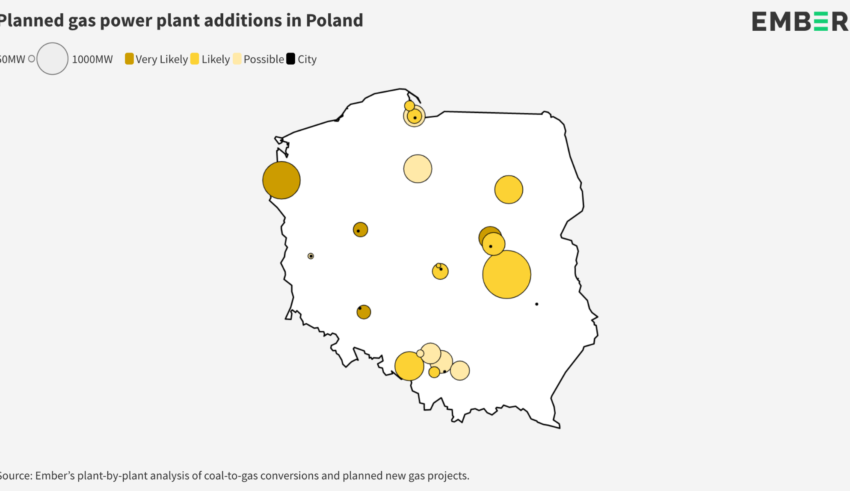

- New gas projects would already overshoot government’s 2030 target

To understand how Poland’s gas plans could play out, we considered planned new gas projects and coal-to-gas conversions. Currently Poland has 3.2 GW of gas power capacity (Instrat, June 2021). However, if all suggested projects go ahead and become operational, Poland will reach 12.9 GW of gas capacity, easily meeting and even overshooting the government’s 2030 target of 8.2 GW. This will also set the country on a trajectory to reach its 2040 target of 15.8 GW.

- 70% of planned fossil gas capacity additions are electricity-only

The majority of the planned and suggested gas additions (6.8 out of 9.7 GW) are electricity-only. Poland’s expansion of gas for electricity is particularly notable, since renewable alternatives are readily available, and are both affordable and in line with EU climate goals. However, PEP2040 undermines the role of renewable energy, giving it considerably less attention.

The largest planned gas projects are PGE’s Dolna Odra (1.3 GW) and Enea’s Kozienice (2.2 GW). Markedly, these planned projects lack consideration as to future-proofing, when gas will need to be phased out to meet zero-emissions targets. There has been no strategy for phase-out announced, or discussion of hydrogen compatibility, for instance. This mirrors PEP2040’s unreflective approach to the future of gas infrastructure in the forthcoming years, putting the country at a risk of investing in assets which will soon become stranded.

RISKS ASSOCIATED

Poland’s track record with large-scale energy projects (eg see WysokieNapiecie and BusinessInsider), combined with its unrealistic assumptions outlined in PEP2040, make it less feasible that all proposed projects will go ahead. However, as the appetite for gas grows in Poland, the risks increase.

- Poland’s reliance on gas beyond 2035 is incompatible with the net zero pathway.

The landmark IEA report released in May this year, Net Zero by 2050: A Roadmap for the Global Energy Sector, set out a comprehensive vision for net zero, outlining key milestones that must be reached to put us on the pathway to limit global warming to 1.5C. Poland’s planned gas expansion and significant reliance on gas for electricity production in 2040 are incompatible with the pathway, as the report underscores the need for zero-emissions electricity by 2035 in all OECD countries.

- Reliance on volatile prices of imported gas is a high-risk strategy

Since Poland does not have fossil gas reserves, a reliance on gas means a reliance on imports. Coupled with the volatility of gas prices, this has the potential to threaten Poland’s energy security and drive up electricity prices for consumers.

In recent weeks, international gas prices have soared, with the EU market reaching an all-time high and quintupling its levels from a year ago, from €10/MWh vs €50/MWh at the end of August. This huge increase in fossil gas prices is due to a combination of factors: a cold winter in the northern hemisphere depleting storage reserves; LNG diverted from Europe to Asia, where high gas demand and prices are tipping the market; and reduced gas flows from Russia via Ukraine. With winter once again approaching in Europe, increases in gas prices look set to continue. These factors underscore the coupling of gas markets around the world, posing a significant threat to the economic viability of Poland’s proposed gas plants and multiplying the risk of Poland being left holding costly stranded assets. The situation observed in recent weeks is quite unprecedented. However, even when taking a look at gas prices over the last 10 years, it can be seen that gas prices yo-yo’d substantially. Exposure to such variations in pricing, for a country that lacks domestic resources, directly translates to increased geopolitical risk.

According to the Act on Energy Law, Energy Security is defined as the state of the economy that enables the coverage of the current and future demand of consumers for fuels and energy in a technically and economically justified manner, while maintaining environmental protection requirements. Given the volatility of gas prices, as well as the low prices of power generation from renewables, there is unlikely to be long term economic justification for the proposed new gas projects.

- Regulatory risks

As a fossil fuel with significant associated greenhouse gas emissions, an increased, long term reliance on gas is in conflict with the EU’s plans for reducing emissions. Pursuing these plans would open up Poland to a series of challenges and roadblocks from regulations designed to meet the EU’s emissions targets and ramp up climate ambition.

Methane strategy

Gas’s climate warming impact goes beyond carbon dioxide emissions from gas-fired power stations. Additional methane emissions caused by gas leakages along the supply chain are currently not addressed by carbon pricing or EU legislation, but with increasing attention on methane’s impact on climate change this is likely to change. This adds to the threat that gas projects will be more expensive to operate in the future. The EU’s ambition to legislate gas associated methane emissions through the EU Methane Strategy signals this likely trajectory. Although the scale and shape of future regulation is yet to be seen, satellite images of methane leaking from operation sites and gas pipes leave no doubt of the scale of the unaccounted-for emissions. The EU will likely aim to use legislative tools to curb methane emissions along the entire supply chain, which would drive up the costs of installing and operating gas plants in Poland.

EU taxonomy

There is also uncertainty around the classification of gas investments as environmentally sustainable or harmful within the EU taxonomy. The final shape of the document is not yet confirmed for gas. However, the Commission’s suggestion to limit financing to projects fulfilling emissions criteria of 270 g CO2/kWh will effectively block support for non-CHP projects. As highlighted above, 70% of proposed gas capacity additions in Poland are electricity-only, and so this would create unfavourable conditions for project finance.

‘Fit for 55’

The EU Emissions Trading System (EU-ETS) reform proposed by the European Commission in July under the ‘Fit for 55’ package ensures that emission allowance prices will remain high, as the volume available is reduced, and now at an even faster rate. Higher EU-ETS prices mean higher operational costs for the gas plants. The reform proposal also includes a requirement that the Modernisation Fund money must not be spent on fossil fuel activities. For Poland, which currently qualifies for 43.4% of the Modernisation Fund, this would mean significantly less funding for the planned gas additions.

The direction of the proposed revisions to the EU-ETS directive also threatens Poland’s plans to establish the Energy Transformation Fund (ETF). Powered by EU-ETS money, Poland’s ETF is expected to support aims outlined by PEP2040 and Poland’s National Energy and Climate Plan. However, if the EU-ETS excludes or restricts financing of fossil fuel projects, Poland might find itself in a position where money for suggested gas projects will be scarce.

- Modelling shows that much less gas is needed

Poland’s plans to expand its electricity-only gas fleet are disappointingly out of step with robust modelling scenarios that show Poland can transition away from fossil fuels and still meet electricity demand. Instrat’s modelling, which is compatible with a 2035 coal exit, shows that the maximum total gas capacity could be just 6 GW (from 2025 to 2030). The analysis also accommodates the role of gas as a transitional fuel, with gas generation peaking in 2025 (30 TWh) and then gradually decreasing until reaching 9 TWh in 2040. Poland’s gas plans far outstrip these moderate gas capacity additions, signaling that gas is being thought of as a long term investment.

Plant-by-plant and policy analysis highlights a stunning lack of future-proofing.This is reflected in the lack of any reference to a gas phase-out or pathway to a fossil-free future, and the absence of details about corresponding requirements for the new projects; e.g. full hydrogen compatibility. Given the lack of evidence on the transition plan for the planned projects, Poland’s track record with fossil fuel phase-out, and likely delays in the investments, we stress that the current trajectory might lock in gas dependency beyond 2050, failing to achieve net-zero.

Concluding remarks

In recent years, discourse about climate action from Poland’s government has been closely linked to improving air quality, which is part of the rationale of moving towards gas since it emits less particulate matter than coal. While we applaud Poland’s desire to reduce air pollution, there is a lack of recognition of air pollution’s close link to greenhouse gas emitting activities, and the importance of tackling both simultaneously. Although CO2 and methane are scentless and not visible, they have an enormous impact on climate change and, therefore, the quality of life and wellbeing of Polish communities. Investing now in wind, solar, storage, and improved infrastructure would address both air quality and climate change concerns, and would also be more forward looking, avoiding the risks outlined above.

By 2023, Poland needs to present an updated version of its National Energy and Climate Plan to the European Commission. In March 2021, the European Commission’s executive vice-president Frans Timmermans said that “Fossil Gas has no viable future”. There is no question that Poland’s starting position is difficult. However, by becoming reliant on gas, Poland risks setting itself up for another painful and costly transition. Changing course towards renewable and clean energy sources now will future-proof Poland’s energy supply and security. And make it less challenging to achieve net-zero by 2050.